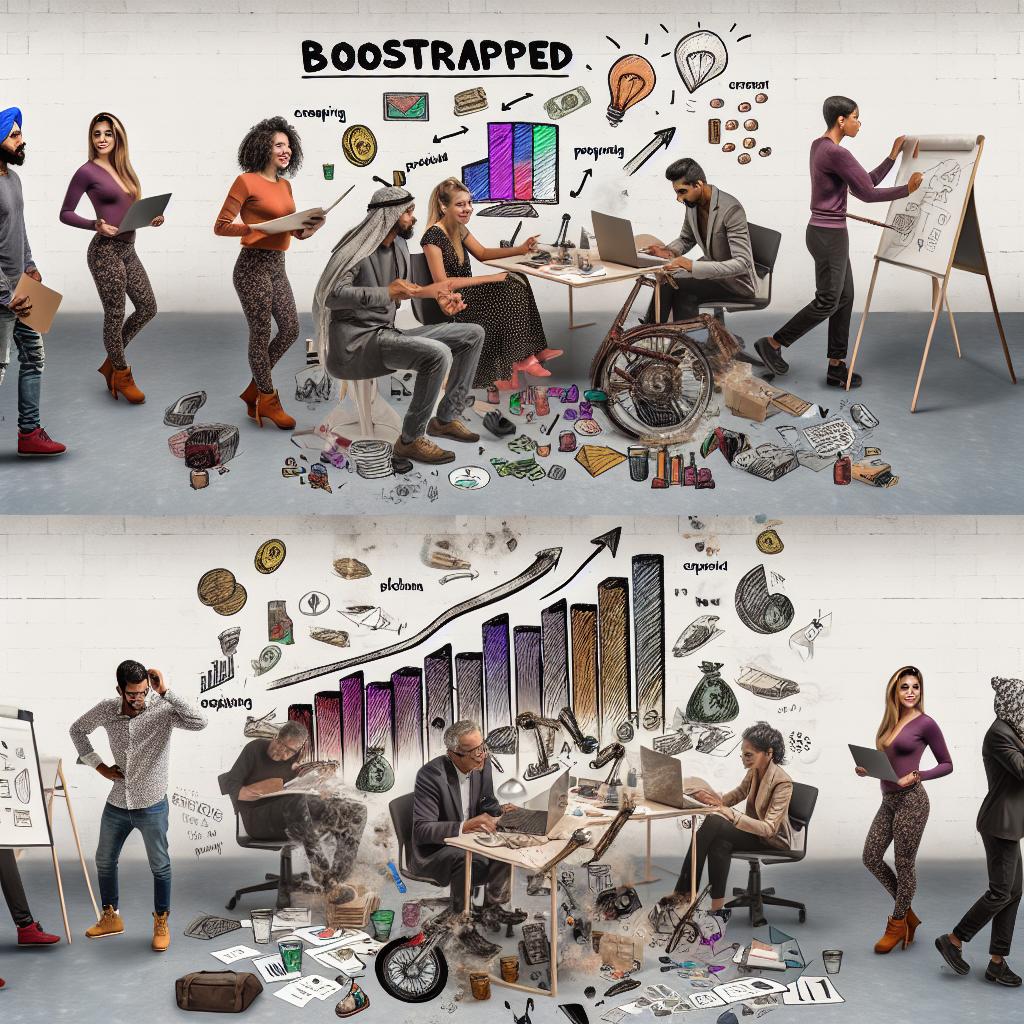

Bootstrapped startup: What are the key growth stages?

- The stages of bootstrapping include the Beginner Stage (using personal resources), Customer-Funded Stage (relying on customer purchases), and Credit Stage for expansion.

- Founders opt for bootstrapping to retain control, minimize entry costs, and avoid equity dilution.

- Successful bootstrapped companies, like GitHub and Basecamp, leverage customer revenue and develop broad skill sets.

- Common challenges include cash flow issues, high risk of failure, and stress from equity management.

- Bootstrapping emphasizes building with minimal resources, prioritizing core development, and preserving equity.

- Pitfalls to avoid include spending too early and lacking a fail-safe plan.

- The approach offers a form of entrepreneurship defined by resilience and self-reliance.

Ever wondered how a bootstrapped startup grows step by step? Think of it like building a rocket—each stage is vital to reach the stars! Whether tapping into personal savings or turning customer dollars into fuel, you’ll uncover each growth stage's unique challenges and victories. So, let's dive into the stages of a bootstrapped startup and see what makes them unique and rewarding.

What Are the Stages of Bootstrapping?

The path of a bootstrapped startup is a journey of grit and resourcefulness. When you're starting out without external help, the road can be challenging. But there's a certain thrill in building a business on your own terms. Let me walk you through the intricate stages of bootstrapping that most successful businesses follow. These stages are your lifeline, and understanding them can make a world of difference.

Beginner Stage: Personal Resources

Bootstrapping usually begins at home — quite literally. You tap into personal resources, which might include your savings and anything of value you can spare. I remember when my friend first started his company, his garage turned into an office, stocked with just a few essentials. In those days, he managed costs meticulously, often listing out potential expenses and finding creative ways to minimize them. Every dollar counted because there were no investors to call, no bank loans lined up.

This stage is critical because it sets the foundation for your future. It requires deciding what's vital for your business growth and what is merely nice to have. Keep operating costs low by prioritizing your spending. You may even find yourself wearing many hats, from bookkeeping to customer service. This experience is invaluable and provides you with a deep understanding of your business operations.

Customer-Funded Stage

As your bootstrapped startup evolves, it transitions into a customer-funded stage. Your customers become your investors, funding your growth through purchases. This stage was crucial for companies like Amazon in their early years, relying on customer sales to drive their operations forward. Think of it as a test of your product’s market worthiness. If customers are willing to pay for it, you know you’re onto something good.

This stage reaffirms the need for a strong focus on customer service and satisfaction. Your product or service must meet high standards and fulfill customer needs to ensure repeat business. Word-of-mouth becomes a powerful tool, and building relationships with your customers can lead to exponential growth. The funds generated here are reinvested directly into the business, fueling development, marketing, or improving services.

Credit Stage for Expansion

Once your business has a steady flow of revenue and a solid customer base, seeking credit for expansion might be the next logical step. Some might question if this still counts as bootstrapping, but when used wisely, credit can accelerate growth. It’s about using small, manageable amounts of debt to finance key parts of your business, like hiring new employees or upgrading technology.

Using credit wisely is essential. I have seen entrepreneurs who meticulously calculate the return on investment before borrowing. They know that it is not about taking loans for the sake of it, but ensuring that the borrowed money directly supports growth objectives. With credit, you keep the wheels of progress turning without sacrificing the freedom bootstrapping provides. It's a fine balance between debt and growth, but when managed well, it leads to a thriving venture.

Understanding these growth stages is vital for any entrepreneur considering bootstrapping. It's about making strategic decisions at each juncture. Whether it’s tapping into personal resources, harnessing customer funds, or leveraging credit, every step points to growth that aligns with your vision. Embrace the stages with focus and courage — the journey, no matter how tough, often leads to remarkable heights of success.

Why Do Founders Opt for Bootstrapping?

Bootstrapping is a path that many founders walk for good reasons. Today, I'll explain why bootstrapping can be a smart choice when starting a business. It offers several advantages, like keeping control, saving on costs, and safeguarding equity. Let's dive deeper into each of these points.

Retaining Control Over Decisions

When you bootstrap, the business is all yours. This means you call the shots. You're not accountable to investors or bound by their inputs. With control over decisions, you shape the company according to your vision. You set priorities, decide which projects to push forward, and pivot when necessary. As seen with bootstrapped successes like Basecamp and GitHub, maintaining control helps in sticking to a core mission. Your decisions can be swift and aligned with the best interest of your business, allowing adaptability in the fast-changing startup world.

This level of autonomy fosters a unique company culture. You can cultivate the values and work environment you believe in. When you dictate your vision without interference, you create a brand aligned with your principles. Many founders find this rewarding and motivating, leading to a strong sense of ownership and pride.

Low Cost of Entry and Emphasis on Core Development

Bootstrapping lets you start with minimal resources. This low barrier to entry means you can focus on the essentials. By necessity, you prioritize the core aspects of your business, ensuring that resources are well spent. This focus often leads to high efficiency and innovation, as seen with Entrepreneur who crafted successful models without hefty initial spends.

Also, an emphasis on essentials helps in finding real market demand. You concentrate on product essentials rather than expanding too soon or focusing on unnecessary features. Many times, bootstrapped companies find creative solutions to serve their audience. This helps in honing a product that genuinely meets the needs of your customers, which can be a competitive advantage.

Avoiding Equity Dilution

Equity is a precious asset. Bootstrapping allows founders to hold onto their share of the company. You avoid giving away equity early, preserving your future returns. Startups often need funding at various stages, but keeping equity can mean bigger rewards down the line. Companies starting with shared equity may struggle with strategic differences among investors, which can dilute the founder's vision.

When you hold equity, you also maintain the potential for future high returns. Look at GitHub's acquisition for $7.5 billion—it shows the power of holding onto equity. In cases of acquisitions or massive growth, founders reap the benefits directly without losing large chunks to external investors. This financial benefit means that entrepreneurs can make strategic decisions that prioritize long-term growth over short-term gains.

In summary, bootstrapping isn't just about being frugal. It's about flexibility, innovation, and empowerment. Founders who choose to bootstrap understand the pros and cons but are drawn to the promise of independence and strong foundational growth. Sticking to these principles, many companies have transformed into industry leaders, proving bootstrapping is a legit path to success.

How Do Successful Bootstrapped Companies Achieve Growth?

Many businesses rise from humble beginnings without outside funding. Bootstrapped startups like GitHub and Basecamp show how this method can lead to massive success. Such companies focus intensely on key growth activities. Let's dive into the paths successful bootstrapped companies take to achieve growth.

Leveraging Customer Revenue

One key to growing bootstrapped companies is leveraging customer revenue. This means using money from sales to sustain and expand the business. Without outside investment, this revenue is vital. For example, GitHub used funds from its first paying customers to hire employees and develop better products. Businesses do not need to hand over control or equity to external investors as they rely on their own revenue streams for growth.

When you know your customer and build for them, each sale becomes your investment. This approach not only helps in minimizing financial risk but also ensues that the company's growth is organically aligned with market demand. Ask yourself, what better way to grow than directly through customer needs and satisfaction? Customer-driven revenue promotes a feedback cycle where the product evolves based on real-world use.

Developing Broad Skill Sets

In bootstrapping, each team member often wears many hats. This means you must develop broad skill sets to handle varied tasks effectively. Successful bootstrapped companies do not have the luxury to hire specialists for every function. Thus, entrepreneurs learn skills ranging from product development to sales and sometimes even legal work. This versatility ensures that critical tasks are addressed without outsourcing.

Being adept in multiple areas helps in spotting opportunities and navigating challenges when resources are tight. Entrepreneurs build resilience through such skills, and it often becomes the backbone of the company's culture. This hands-on way of operating ensures a deep understanding of every aspect of the business, leading to informed decision-making and optimized processes.

Case Studies: GitHub and Basecamp

GitHub and Basecamp present great examples of bootstrapped success. GitHub began as a side project by a few developers who needed a better way to share and collaborate on code. With no outside funding, they relied on their own efforts and initial customer revenue to grow. Over time, GitHub expanded its user base to serve millions of developers, leading to its acquisition by Microsoft for $7.5 billion in 2018.

Basecamp, started by Jason Fried and David Heinemeier Hansson, followed a similar path. The founders focused on simplicity and customer satisfaction. They didn't rush to raise funds, opting instead to hone their product based on real user feedback. Their dedication to offering a clear, invaluable service resulted in strong, lasting customer relationships. This approach aided their growth without external capital injection. Basecamp's success showcases the power of product focus and listening to users' needs.

The key growth stages for these companies centered around leveraging customer revenue and developing broad skills internally. The journey was built on understanding and meeting customer needs without relying on outside investors. GitHub's and Basecamp's stories remind us that enduring success can stem from careful, customer-driven growth and proficiency across diverse business tasks. By focusing on these skills, bootstrapped companies foster a culture of resilience and agility, paving their way to success.

What Challenges Do Bootstrapped Startups Face?

Starting a bootstrapped startup is like diving into a deep, vast ocean with nothing but your trusty old raft. It’s thrilling but also filled with challenges. You'll rely on personal savings and customer revenue — no external funding cushion. Let’s dive into some key challenges you might face:

Cash Flow Issues

Why do bootstrapped startups often face cash flow troubles? Because they use profits to grow. Simple, right? But it’s also risky. With every cent tied up, an unexpected expense could mean big trouble. It's like living paycheck to paycheck. You’ve got just enough to cover expenses but nothing extra for surprise costs. Slow sales or late payments from customers can hurt cash flow. How can you avoid this? Keep costs low and strive for quick inventory turnover.

Look at examples like Dell and Apple. They kept their cash flow stable by managing expenses tightly and focusing on profitable sales. These companies used creative strategies to handle cash flow problems without outside investments.

High Risk of Failure

Is it true bootstrapped startups take more risks? Yes. Without external investors, you carry the full weight of failure. This means every decision can make or break the business. Imagine walking a high-wire without a safety net. Miss one step, and you’re in trouble. Bootstrappers rely on their skills and fast decision-making to reduce these risks.

Many entrepreneurs love this challenge—it pushes them to innovate and grow. Still, the fear of failure can be daunting. Having a clear business plan and focus is key. Learn from companies like GitHub and successes like GoPro, which thrived with lean operations and smart choices.

Equity and Stress Management

How does stress tie into equity management? Without investors, entrepreneurs hold full control. This seems amazing—but handling everything alone can create great stress. Managing equity among co-founders can spark disputes. If there’s a disagreement on direction or roles, conflicts arise easily.

Why does this matter? Equity disputes can break partnerships and put the whole business at risk. Finding fair ways to split ownership and responsibilities is crucial. Stresses extend beyond equity; personal stress can quickly develop without a strong support system. You’ll face constant pressure to keep things afloat.

Successful bootstrappers, like those at Basecamp or Clorox, found ways to manage effectively. They focused on building positive team culture to handle stress, creating strategic plans to keep everything running smoothly.

Pitfalls to Avoid

Are there known bootstrapping pitfalls to avoid? Yes. One big mistake is spending too much too soon. Another is neglecting a fail-safe plan, in case things don’t go as expected.

When you’re bootstrapping, every step is calculated. You learn to pivot quickly, cut unnecessary expenses, and prioritize profit-driven activities. Successful founders know this means sometimes saying no – to fancy offices, to big PR campaigns, or to rapid scaling before you are ready.

In sum, understanding bootstrapping is like preparing for a unique adventure. It involves focus, fierce determination, and a willingness to face challenges head-on. Yet, despite the risks, bootstrapping offers the purest form of entrepreneurship—building something from almost nothing. With clear strategies and relentless drive, many bootstrapped startups carve pathways to great success while navigating through the profound challenges that define their journey.

Conclusion

Bootstrapping a startup takes you through stages: personal funds, customer funding, and credit expansion. Founders choose bootstrapping to keep control, reduce costs, and avoid equity dilution. Successful firms like GitHub thrive by leveraging customer revenue and developing diverse skills. However, bootstrapping comes with challenges like cash flow issues and stress management. Mastering these elements turns risks into growth opportunities. Whether you're gearing up for a new venture or seeking to understand industry trends, bootstrapping offers valuable lessons in resilience and innovation.