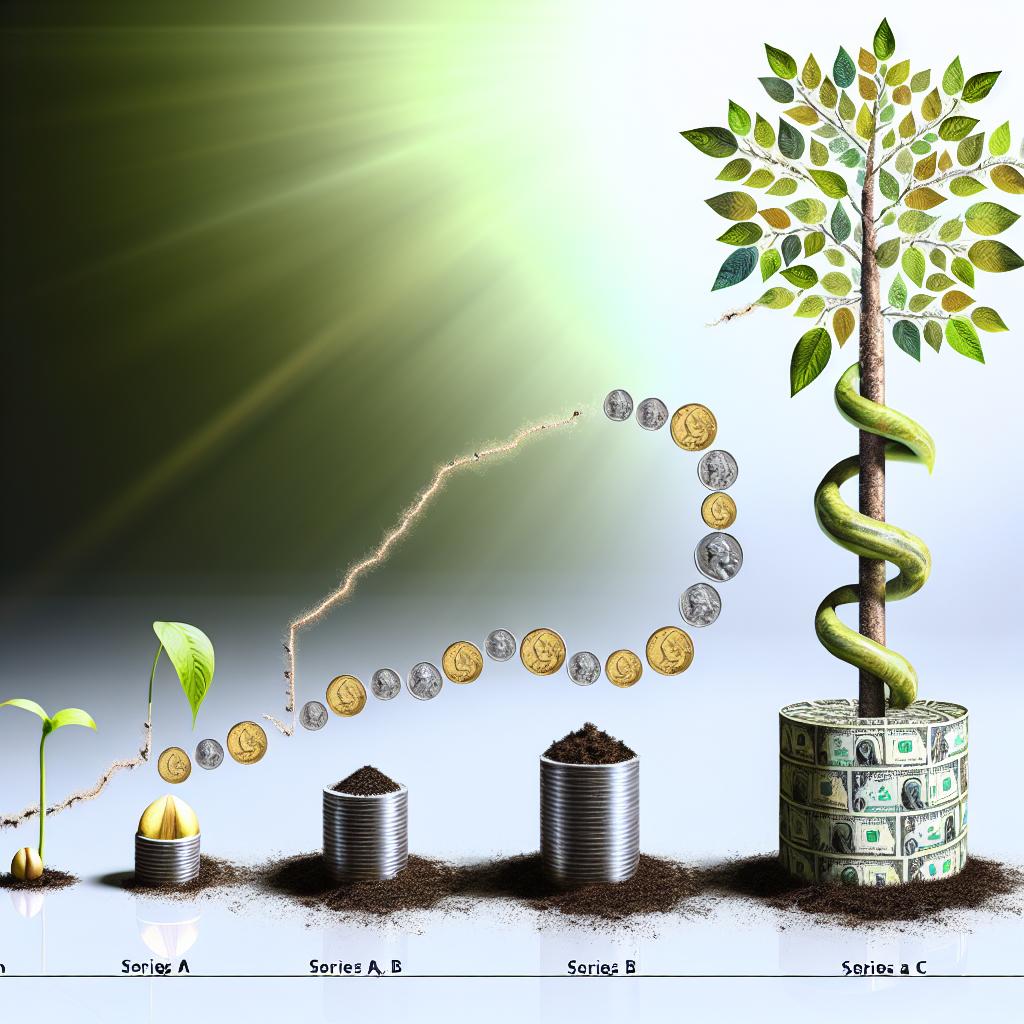

Stages of venture capital funding: How do they differ?

-

Pre-seed Stage Overview: The pre-seed stage is where startups begin, relying on personal savings (bootstrapping), and small funds from family and friends.

-

Fundraising Tactics: Strategies include networking, attending events, building a strong pitch, and seeking startup accelerators for mentorship and initial funding.

-

Seed Stage: Focuses on securing initial funding to prove concepts and develop products with a compelling pitch deck.

-

Series A Funding: Used for product refinement and growth, highlighting revenue metrics to attract investors.

-

Series B Goals: Emphasizes rapid scaling by strengthening teams and market position with strong performance metrics and strategic investor engagement.

-

Series C and Beyond: Involves diversifying business models, expanding into new markets, and considering strategic acquisitions for exponential growth.

-

Mezzanine Stage: Preps companies for IPOs by securing funds and supporting investor exit opportunities.

-

IPO Transition: Provides capital, raises public profile, offers employee stock benefits, and enhances merger opportunities.

In the whirlwind world of startups, understanding each venture capital funding stage is key. This guide unpacks how they lift a tech startup from an idea to a thriving enterprise. We dive into every step from pre-seed to the IPO exit, uncovering what sets them apart. When is it time to pitch for Series A? What makes Series B different from Series C? Let's explore these stages crucial for funding your tech dreams.

What Happens in the Pre-seed Stage?

The pre-seed stage marks the beginning of a startup's journey. It’s often where dreams begin to take a tangible form. In this stage, founders rely on their own resources, close-knit networks, and smaller financial support from friends and family. It's a stage filled with passion and grit as entrepreneurs set out to build their ideas.

How Do Startups Use Their Own Resources in Pre-seed?

Startups begin by using what they have. Founders often tap into their savings to kickstart their business. This might cover costs for initial research and basic operational activities. Often, entrepreneurs also continue to work part-time on other jobs, funneling any earnings back into their budding business. It's a juggling act, balancing time and money, but it is crucial in transforming a mere idea into something concrete. This self-funding is known as bootstrapping, where being resourceful is key. Sometimes, founders also use equipment or software that doesn’t need immediate payment, helping reduce initial costs.

What Role Do Family and Friends Play in Pre-seed Financing?

Family and friends are often the first investors in a startup. They believe in the person behind the idea, offering trust and support. This type of funding is known as love money because it's given out of personal belief rather than a business decision. The funds from family and friends can help with product prototypes or basic logistics. This early-stage capital is often small but essential. It provides the initial push needed to develop the business further. However, it's also important to present clear plans and possible returns. Family and friends should be aware of the risks and challenges involved. Creating clear agreements protects both parties and helps maintain personal relationships.

What Are Effective Pre-seed Fundraising Tactics?

Raising funds in the pre-seed stage requires strategy. Networking with industry folks increases exposure to potential investors. Attending startup events and pitching competitions can also open doors for funding opportunities. Building a solid and concise pitch is crucial. This pitch should highlight the product idea and its market potential. Securing funds often hinges on selling the vision compellingly. Demonstrating a clear understanding of both the problem and the solution sets you apart. Some startups seek out startup accelerators. These organizations, like Angelpad and Speedinvest, offer mentorship and initial funding. They prepare startups for further stages with structured programs and expertise. Having a trusted mentor or advisor can also provide valuable insights and connections. Another avenue is online platforms where startups can reach out to potential investors. Creating a strong online presence is necessary for attracting interest. Finally, demonstrating early user feedback or interest can be persuasive. Showing tangible proof of demand can sway even cautious investors to take a chance.

In sum, the pre-seed stage is about building a foundation that will support growth. It's the initial push from dreams to reality, fueled by personal belief and strategic networking. Success here paves the path for advancing to the next steps in the startup journey.

How Does the Seed Stage Propel a Startup Forward?

The seed stage is like planting a seed in the hopes of growing a strong tree. It's a startup's first step in securing real outside funding. This stage often determines the direction of the startup and its chances of future success. Here, a startup aims to prove its concept, develop its product, and validate its market, all fueled by the initial funding acquired. Understanding the seed funding basics helps to grasp why this phase is crucial in a startup's journey.

Why Is a Pitch Deck Essential in the Seed Stage?

Having a compelling pitch deck is key in the seed stage. It serves as your story, your vision, in a concise package. So, why is it so vital? Precision answer: Investors need to quickly understand your idea and its potential. With this tool, you showcase your business plan, introduce your team, and outline your financial strategy. It's essential to clearly communicate your market research and your competitive edge. Investors want to see the problem your product solves and its place in the market. You might wonder how detailed this needs to be. Ensure it is thorough but straightforward, leaving no room for doubt regarding your vision.

How Do Startups Demonstrate Market Potential?

Market potential is your startup's ticket to future growth. Startups need to prove that there are customers interested in their product. To do this effectively, they need solid data and customer feedback. Precision answer: Through market research, surveys, and a clear customer identification. This involves understanding your target audience, the size of that market, and how your product meets their needs. Show early traction with numbers, like the number of sign-ups or sales, even if they're modest. Small victories in user adoption can suggest broader potential. Be clear about your marketing strategies, how you will reach your customers, and your sales forecast, which is essential in convincing investors of a worthy market potential.

What Is the Timeline for Advancing from Seed to Series A?

The timeline can often seem daunting for founders planning their route forward. Generally, it takes about 12 to 18 months to move from seed to Series A. Precision answer: Prepare early by establishing clear milestones and tracking progress. Meeting these milestones is crucial in proving to investors that the business is ready for the next stage. Spend this time on product development, user engagement, and growing your market reach. By hitting these goals, you build a compelling case for securing seed funding for startups. Founders should anticipate challenges and be adaptable, paving their road to Series A funding with reliable evidence of growth and potential.

This journey is not linear, and it requires dedication and a strong strategic approach. Prepare feedback loops, iterate on your product, and consistently stay updated with market trends and customer preferences. The aim is always to show a trajectory of growth, which is the most convincing metric for investors eager to engage in Series A funding.

What Distinguishes the Series A Stage?

The Series A stage marks a key point in a startup's journey. After the seed stage, Series A funding focuses on product refinement and company growth. Winning Series A funding needs a clear plan, a viable product, and proof of early success. This stage is where you move from idea to refined execution. So, let's dive into what makes Series A funding distinct.

How Does Series A Funding Help in Product Refinement?

Series A funding first helps a startup refine its product. It provides capital to improve features and fix flaws. Does your product solve a problem? Investors want details. They need to see a clear use for your product. You should also show how your product stands out in the market. Series A funds might hire new experts. These experts improve technology, test theories, and polish the product. Product tweaks can boost user feedback, leading to better overall improvement.

What Are the Critical Components of a Business Plan at This Stage?

A strong business plan is vital in Series A funding. What do investors look for? First, a clear plan for growth. You need to outline how you plan to increase users and product reach. Include a marketing plan that explains how to attract more customers. Show tactics for entering new markets. Next, financial forecasts are key. Show how you expect revenue to grow over time. Investors want to see a path to making money. Forecasts should include past earnings, projected profits, and planned spending. Last, highlight your team. A strong team increases investor confidence. An experienced, talented team reassures investors and drives the path to success.

How Are Revenue Metrics Used to Attract Series A Investors?

Revenue metrics show if a startup can grow and make money. Attracting Series A investors depends a lot on these numbers. What metrics do investors value? They want to see clear income levels and growth trends. Are your sales going up? That’s a good sign. Compare with industry trends. This comparison shows how well your company is doing against others. Investors want strong and steady growth. So, business models should be clear. They should detail product pricing and potential profits. While revenue is crucial, don’t forget user engagement. High user activity ties into potential income growth. With good metrics, you stand out to investors.

The Series A Stage and Startup Growth

Series A funding means big changes. Refining products, shaping business plans, using clear revenue metrics all guide this journey. They change ideas into successful businesses. They help startups scale, enter new markets, and stand on solid ground. As an entrepreneur, mastering this stage is crucial for growth and success.

For example, companies like those at Techstars and 500 Startups help startups at this stage. They guide the refinement process, help with strategic plans, and stress the importance of metrics. By focusing on these areas, you not only secure funds but also build a strong future path.

What Are the Key Milestones in Series B Funding?

Series B funding is a crucial part of a startup's journey. It's where real growth happens. This stage focuses on scaling the business in a big way. Companies look to expand their teams and increase their market reach. But there’s more to Series B than just growing fast. So, let's dive into how Series B helps startups scale, how performance metrics play a role, and what strategies you can use to woo investors.

How Does Series B Support Startup Scaling?

In Series B, the goal is to grow fast and solidify market position. At this point, your company should already have a product that fits the market well. Now comes the hard part: scaling that success. This requires more than just money. You'll need resources to build a larger team and invest in marketing. Increasing production to meet growing demand is also key. So how does Series B make this possible? First, it brings in substantial cash, which you can use to hire talent. More skilled people mean your company can take on bigger challenges. The funding helps you to increase your marketing efforts. Expanding the brand’s reach brings new customers. It can also help refine and strengthen your business systems. You create repeatable success patterns by improving operations. These changes make scaling sustainable, not just a one-time growth spurt. The main objective here is to maintain quality while growing size. You don't want to lose focus on what makes you unique while you expand.

How Do Performance Metrics Influence Series B Investment?

Metrics are more than just numbers; they tell your business's story. Investors use these figures to decide whether you are a good bet. In Series B, performance metrics are even more crucial. They show how ready you are for the next level of growth. Investors pay special attention to your revenue numbers and profit margins. Stable, growing revenue tells them you have a viable market fit. High profit margins show you're using resources efficiently. Metrics like Customer Acquisition Cost (CAC) and Customer Retention Rate (CRR) are also key. A low CAC means you spend less to gain new customers. A high CRR indicates your product keeps customers coming back. Your Business's Monthly Recurring Revenue (MRR) growth is important. It shows the income you can expect regularly. That steady income reassures investors about future performance. Investors want proof that money injected into your company won’t vanish. Therefore, keep your metrics up-to-date and clear. They serve as the proof of your growth story. Tracking metrics prepares you for investor questions. You’ll have facts and figures rather than just optimism.

What Strategies Are Used for Engaging Series B Investors?

You must have a strategic approach to convince investors during the Series B stage. It's not just about showing plans. People often wonder: How do startups secure these vital funds? First, identify investors who align with your vision. You're not just looking for money; you want partners who share your goals. Building relationships before seeking funds pays off here. Personal connections can make it easier to show your worth. Next, tailor your pitch with your performance metrics. Investors love a story backed by solid data. Share how you plan to allocate the funds effectively. Having a clear plan reassures investors you will use their money well. Demonstrating your team’s strength is crucial too. Why is this? Because investors are buying into people as well as plans. Show that your team is capable of executing the growth strategy. Don't forget to highlight your market edge. Explain why your product or service will succeed in the long run. Differentiation is key for sustainability. You only get one chance to make a first impression so practice engaging pitches. Make sure your team knows the pitch well enough to handle objections or questions. Finally, remain open to feedback. Investors often offer valuable insights. Adapt your plans and show you’re quick to react to advice. Their experience can guide your venture to new heights.

In Series B, scaling is the ultimate goal. You achieve this by mixing strong metrics with strategic funding and ensuring everything you do answers the question, "How will this help us grow?"

How Is Growth Achieved in Series C and Beyond?

Venture capital funding plays a pivotal role in helping startups grow from a small team with a big idea to a major player in the market. In the Series C stage and beyond, securing investments is about more than just money. It’s about scaling up in every aspect of the business to maintain exponential growth. Let’s dive into how growth is achieved in this crucial stage.

What Drives Exponential Growth in Series C?

New opportunities and strategic moves are key. A startup has shown enough potential in previous stages; now, it's time to go big. At this point, a company seeks capital to expand products, reach new customers, and fortify its place in the market. This stage involves diversifying the business model and focusing on what works best for the company.

Investors from different backgrounds show interest here. Beyond traditional venture capitalists, we see interest from hedge funds, investment banks, and private equity firms. This lineup of diverse investors indicates the startup's growth potential and allure. But why does this happen? The company is deemed competent enough to give these investors confidence in getting worthwhile returns.

How Do Startups Expand into New Markets?

Expanding into new markets requires a deep understanding of different customer bases and regions. A successful strategy involves market research and adapting products to meet local needs. Think of companies like Airbnb or Uber. They had to tailor their services for international success.

Launching in new markets can mean adapting marketing strategies to match local cultures and laws. Regulatory matters are critical, too. Securing the proper licenses and following rules are necessary steps. Companies sometimes partner with local firms that know the market landscape well.

Their presence in multiple locations acts as a springboard for global domination. However, careful analysis and planning are needed. A misstep in understanding market nuances can derail growth. That's why strategic planning is vital for a smooth and impactful launch into new territories.

Why Might Acquiring Other Startups Be Strategic?

Acquisitions can be a game-changer. They allow a company to instantly access new technology, talent, and an established customer base. When Instagram joined Facebook, for instance, Facebook gained enhanced photo-sharing capabilities and a larger user community.

Acquiring other startups also removes competition. It’s an effective way to prevent rivals from catching up in innovation or reach. These acquisitions are akin to short-cuts. Instead of building from the ground up, a company can leverage what another has accomplished.

Growth through acquisitions isn’t only about taking in smaller companies. Sometimes, merging with equal-sized companies combines strengths. This merger can amplify reach and fortify market presence. It's both an offensive move to broaden abilities and a defensive strategy against potential competitors.

At the end of the day, in the Series C funding stage, it is about scaling fast while ensuring a strong foothold in newly acquired and existing markets. External investments propel these actions, but a well-thought-out execution plan makes the strategies fruitful.

The journey doesn't stop with Series C. Later stages, such as Series D and E, build upon these foundations to secure a sustainable market-leading position. These stages involve more nuanced strategies but rest on the robust groundwork laid during Series C.

In tackling venture capital funding, a clear understanding of each stage's unique requirements is essential. Series C isn't the finishing line; it's just part of the broader landscape of venture capital. For further insights into how these strategies play out, check out Sequoia Capital's insights or Accel's perspectives. Understanding these dynamics will help you appreciate how startups navigate the intricacies of growth-focused funding.

What Is the Role of the Mezzanine Stage?

The Mezzanine stage is crucial for companies nearing a big shift. Typically, at this point, startups eye an Initial Public Offering (IPO) or acquisition. Mezzanine funding, often acting as a bridge, supports these transitions with vital resources. It links late-stage growth with public success, helping firms prepare for their new life. But how exactly does this stage function? Let's dive deeper.

How Does the Mezzanine Stage Facilitate an IPO?

An IPO is a monumental step for any business. In simple terms, it means a company can sell its shares to the public. The Mezzanine stage supports this by providing funds and guidance for the transition. Companies often need extra capital to get ready for an IPO. This capital helps with financial audits or boosting market visibility. By doing so, companies strengthen their financial position and market image. As a firm prepares for an IPO, having clear financials and a strong brand becomes crucial. Hence, late-stage venture capital plays a key role in aiding these targets while ensuring the company stays strong and competitive.

What Opportunities Exist for Investor Exit?

The Mezzanine stage offers investors a golden chance to exit. Many early investors look forward to this moment. It’s an opportunity to cash out after years of support. The venture capital journey begins with risks and ends with rewards here. Once a company reaches the Mezzanine phase, a likely IPO or merger keeps investors interested. An exit strategy is vital; it ensures they benefit from the company's growth. Thus, the Mezzanine stage acts as a launchpad for these exits. Investors can sell shares or trade them post-IPO. For them, it's the golden moment their journey aimed at since they first believed in the startup's potential.

How Do New Investors Support the Public Transition?

New investors often emerge at the Mezzanine stage with fresh ideas and funds. Late-stage investment strategies attract those who see promise in public transitions. These investors provide financial support and strategic counsel. Their involvement boosts confidence and helps smoothen the company's path to public listing. Moreover, they assist in growth strategies vital for public readiness. They bring in expertise, ensuring all systems align for a future IPO or merger. Thus, they serve as both catalysts and pillars during this significant phase. This stage can attract firms like Lightspeed Venture Partners offering assurance through experience.

Mezzanine equity is more than financial support; it coordinates efforts toward a definite target. This kind of investment is the engine behind a startup's final sprint to public recognition. By understanding and embracing it, companies ensure they not only reach the finish line but do so with strength and purpose.

How Does a Company Transition to the Exit Stage, like an IPO?

The exit stage is like the grand finale in the venture capital journey. This is when a company goes public, often through an Initial Public Offering (IPO). Transitioning to this stage is a significant leap. First, a company needs to show strong growth and stability. It must have a solid track record, showing it can make money consistently. Potential investors want proof that the company is ready for the big league.

Preparing for an IPO involves a lot of preparation. The company hires investment banks to guide them. These banks help set the share price, market the IPO, and find investors. This process showcases the company’s strengths and potential to the public and regulators. A company’s current financial health and market position are critical in this stage.

How Does Going Public Benefit a Company?

There are many benefits to going public. The most obvious is access to large amounts of money. Companies can use this new capital to grow, whether it's expanding production, entering new markets, or developing new products. Importantly, an IPO can increase a company's visibility. It can help the company gain media attention and boost its reputation.

A public listing also lets a company to use its shares to acquire other companies. It provides more flexibility in strategic decisions. Being public can improve credibility, potentially opening up more business partnerships.

What Are the Advantages of Public Stock for Employees?

Employees can benefit from a company going public as well. Stock options are a big plus. Many startups offer early employees the chance to buy company stock at a set price. With an IPO, stock can be sold on the open market. This can provide a significant financial boost for employees.

Having stock in a public company can improve employee loyalty and morale. It gives employees a stake in the company's future. This can be motivating, driving them to work their best to increase company value.

How Does an IPO Enhance Merger Opportunities?

Mergers and acquisitions become more accessible after an IPO. Public companies, with stock as currency, can negotiate with more power and flexibility. Other companies might find merging more appealing, especially if the public company has a strong stock market performance.

An IPO helps a company gain brand recognition and clout. It can increase the appeal of mergers. This can accelerate growth, as new synergies are formed, and market shares expanded. Strong public performance can make a company a very attractive partner.

Getting to the IPO stage is a long journey. It requires thought and strategy at every step. The decision to go public is not just a financing decision but a commitment to new standards and scrutiny. It opens doors to new opportunities, but it also brings new challenges. Understanding these benefits and processes can demystify the IPO transition for entrepreneurs and investors.

Conclusion

From pre-seed insights to the exit stage, startups navigate a thrilling journey. In the pre-seed stage, securing funds often involves personal networks and clever fundraising tactics. As startups progress, the seed stage becomes crucial for market validation and crafting a compelling pitch. Series A through C drive growth, with each stage demanding a robust plan and clear metrics. The mezzanine stage sets the stage for going public, offering new investor opportunities. Each step is vital for future success. Embrace each challenge and milestone, and you'll unlock growth and innovation opportunities.